cryptolandia.site

Community

Should I Buy Gold Etf Now

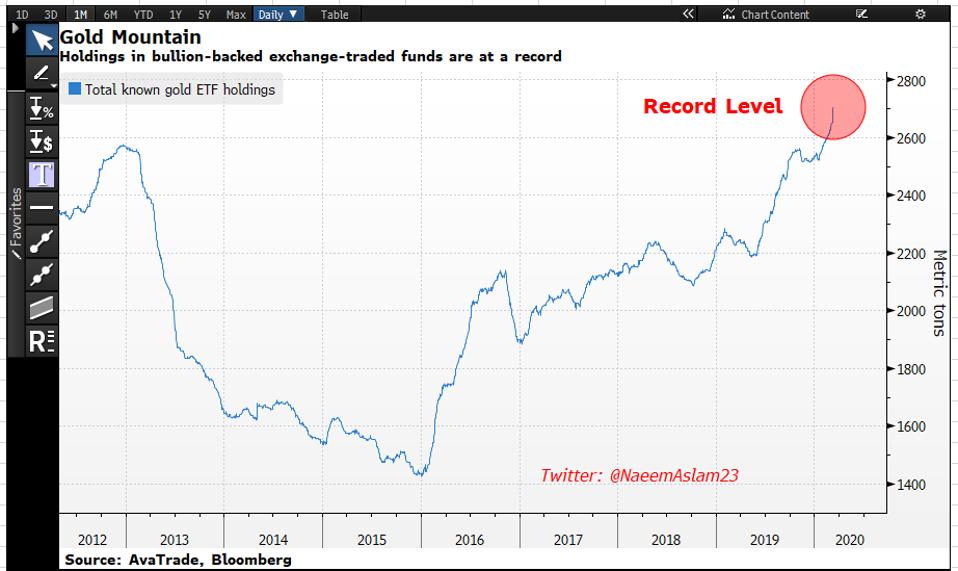

However, for those seeking to protect their wealth and savings from the unraveling dollar, investing in gold through ETFs can have some major disadvantages. For. Gold ETFs are a great way to build reserves for the future without having to physically store gold. ETFs that track gold can be a more liquid and cost-effective way to go, with several funds now available that have expense ratios as low as %. You Can Buy. Gold has historically acted as a safe haven asset during times of volatility. Find out how to add gold to your portfolio with iShares Physical Gold ETF. Gold is uncorrelated to both stocks and bonds. Generally increases risk adjusted returns when combined with a traditional 60/40 portfolio. Gold ETF List. Gold ETFs provide investors with exposure to gold by tracking the price changes of gold. This allows investors to profit from gold price. If you want to hold a gold ETF for the ease of trading and liquidity I suggest you invest at least as much in physical gold coins that you hold. While investors should weigh each option to determine the best method for their circumstances and risk tolerance, gold price ETFs and gold streaming and royalty. Buy a gold-backed ETF and you gain exposure to the price of gold, not actual, physical gold. Owning shares in a gold ETF is not the same thing as owning. However, for those seeking to protect their wealth and savings from the unraveling dollar, investing in gold through ETFs can have some major disadvantages. For. Gold ETFs are a great way to build reserves for the future without having to physically store gold. ETFs that track gold can be a more liquid and cost-effective way to go, with several funds now available that have expense ratios as low as %. You Can Buy. Gold has historically acted as a safe haven asset during times of volatility. Find out how to add gold to your portfolio with iShares Physical Gold ETF. Gold is uncorrelated to both stocks and bonds. Generally increases risk adjusted returns when combined with a traditional 60/40 portfolio. Gold ETF List. Gold ETFs provide investors with exposure to gold by tracking the price changes of gold. This allows investors to profit from gold price. If you want to hold a gold ETF for the ease of trading and liquidity I suggest you invest at least as much in physical gold coins that you hold. While investors should weigh each option to determine the best method for their circumstances and risk tolerance, gold price ETFs and gold streaming and royalty. Buy a gold-backed ETF and you gain exposure to the price of gold, not actual, physical gold. Owning shares in a gold ETF is not the same thing as owning.

If you are using investments in gold as a diversification tactic, stick to ETFs. But I should warn you, gold is not an investment - it is a. Gold can be seen as a good investment all-year round, whether the financial markets are in a bullish or bearish phase. This is because the metal tends to. 4 Reasons Why Investors Should Avoid Gold ETFs · 1. You Don't Actually Own Gold · 2. ETF Fees · 3. Counterparty Risks · 4. Significant Market Risk. GLD is one of the most popular ETFs available. The fund invests in physical gold, and its performance is highly correlated to gold spot prices. Gold Exchange Traded Funds (ETFs) are a great investment choice if you find buying physical gold prices inconvenient, or if you want to diversify your. Why invest in gold · Diversification: The most common reason retail investors buy gold ETFs is diversification. · Lower correlation to the stock market. Gold ETFs make investing in gold simple. You can buy and sell shares easily on a stock exchange, just like regular stocks. And your investment return is tied. Gold ETFs allow investors to trade shares tied directly to the market price of gold, offering high liquidity and lower transaction costs than. With the emergence of Gold and Silver ETFs, you can now get the benefit from the price movements of bullion without having to purchase physical gold or silver. After you've done your research and weighed your options, you're ready to buy Gold ETFs. The process is straightforward and should be familiar if you've ever. This demand makes "a strong case" for gold in the year ahead, State Street says. Why should I invest in gold? Gold investors typically tout several virtues of. Gold ETFs get rid of the hassle of storing physical gold · Gold ETFs are like buying the metal as carat gold units · Gold ETFs are safe and secure and you do. Gold funds have gained traction among both new as well as seasoned investors in the past. That's because investments in gold ETFs are considered to be. Could Investing in Gold Add a New Dimension to Your Portfolio? · While gold isn't a strategic asset class, there are tactical reasons to consider adding it. See. The main benefit of a gold ETF is accessibility and flexibility. Investors can easily access the asset through a brokerage account. To answer this, it's essential first to understand what a gold ETF is. ETFs, or exchange-traded funds, pool investments from many individual investors. Gold ETFs have proved to be worthier than physical gold, since gold ETFs not only ensure your investment in the yellow metal, but also provide the flexibility. Gold ETF Summary · Gold backed Exchange Traded Funds (ETFs) are securities designed to track the gold price · If you buy shares in a gold ETF you do not actually. Buying Gold ETFs are a great way to diversify your investment portfolio and it doesn't take a large upfront capital. Furthermore, re-allocating some of your. On an inflation adjusted basis, gold today is worth less than it was in cryptolandia.site

Safest Stocks For Long Term

Long-Term Care Planning. News & Research. News · Wealth Management Insights You can add a safety net to your financial plan by diversifying your savings and. 3) Money Market Funds Money market funds are low-risk as they invest in stable, short-term debt instruments and certificates of deposit. Though rates are. However, buying a diversified portfolio of high-quality companies at reasonable prices is among the most reliable ways to build wealth over the long-term. 7. Best Safe Stocks to Buy Right Now · 1. cryptolandia.site Inc. (NASDAQ: AMZN) · 2. NVIDIA Corp. (NASDAQ: NVDA) · 3. Berkshire Hathaway Inc. (NYSE: BRK) · 4. Procter and. As you might imagine, this is more of a cash alternative than a way to generate wealth over the long run. Treasury securities are perfectly safe, and the short. short-term obligations. 4. Look at dividend growth. Generally speaking, you want to find companies that not only pay steady dividends but also increase them. Buy-and-hold is a passive, long-term investment strategy that creates a stable portfolio over a long period of time to generate higher returns. Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies [Siegel, Jeremy J.] on cryptolandia.site 1. Tata Consultancy Services (TCS). TCS is often considered a safe investment due to its consistent growth in the IT sector. · 2. HDFC Bank · 3. Larsen & Toubro. Long-Term Care Planning. News & Research. News · Wealth Management Insights You can add a safety net to your financial plan by diversifying your savings and. 3) Money Market Funds Money market funds are low-risk as they invest in stable, short-term debt instruments and certificates of deposit. Though rates are. However, buying a diversified portfolio of high-quality companies at reasonable prices is among the most reliable ways to build wealth over the long-term. 7. Best Safe Stocks to Buy Right Now · 1. cryptolandia.site Inc. (NASDAQ: AMZN) · 2. NVIDIA Corp. (NASDAQ: NVDA) · 3. Berkshire Hathaway Inc. (NYSE: BRK) · 4. Procter and. As you might imagine, this is more of a cash alternative than a way to generate wealth over the long run. Treasury securities are perfectly safe, and the short. short-term obligations. 4. Look at dividend growth. Generally speaking, you want to find companies that not only pay steady dividends but also increase them. Buy-and-hold is a passive, long-term investment strategy that creates a stable portfolio over a long period of time to generate higher returns. Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies [Siegel, Jeremy J.] on cryptolandia.site 1. Tata Consultancy Services (TCS). TCS is often considered a safe investment due to its consistent growth in the IT sector. · 2. HDFC Bank · 3. Larsen & Toubro.

Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies [Siegel, Jeremy J.] on cryptolandia.site This is due to an increased net price and an improved mix. Meanwhile, earnings per share came in at $, and long-term investment stocks received plenty of. Best long-term stocks to buy now · UnitedHealth (UNH) · Elevance Health (ELV) · Applied Materials (AMAT) · Alibaba Group Holding Ltd (BABA) · Cisco Systems Inc. . However, buying a diversified portfolio of high-quality companies at reasonable prices is among the most reliable ways to build wealth over the long-term. 7. But as investors bid up good and bad businesses alike, that can make it hard to discern which companies are the best dividend stocks for long-term investors. Buying a stock is deceptively easy, but purchasing the right stock at the right time without a proven strategy is incredibly hard. So, what are the best. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. When the general stock market drops precipitously, a market-wide circuit breaker may be triggered. · Bear market: When a stock or bond index, or a commodity's. Safe mid cap stocks for long term ; 8. Ajanta Pharma, ; 9. Natco Pharma, ; Indraprastha Gas, ; Coforge, Vanguard ETFs ; Bond - Inter-term Investment · Stock - Large-Cap Blend · Bond - Long-term Government ; 2 · 4 · 5. Best Safe Stocks to Buy Right Now · 1. cryptolandia.site Inc. (NASDAQ: AMZN) · 2. NVIDIA Corp. (NASDAQ: NVDA) · 3. Berkshire Hathaway Inc. (NYSE: BRK) · 4. Procter and. best long term stocks · 1. Ksolves India, , , , , , , , , , , · 2. Nestle India, Safety in Numbers - The Safest Stocks to Buy · Infosys · Hindustan Unilever · HDFC Bank · Reliance Industries · Tata Motors · Tata Consultancy Services. Trust and Safety · What is Account Takeover (ATO) Fraud: How to Protect Yourself. 29 August 4 min read. What is CPR in Trading · Stocks · What is CPR in. Quarterly pitches for stocks with intriguing valuations and long-term prospects along with updates to our model portfolios. Stock and fund screeners: Apply. The Safety of Blue Chip Stocks Blue chip stocks are the titans of their sectors—industry-defining companies that are well-known, well-capitalized, long-term. U. S. savings bonds are Simple Buy once. Earn interest for up to 30 years Safe Backed by the full faith and credit of the U.S. government Affordable. The 10 best long-term investments · Growth stocks · Stock funds · Bond funds · Dividend stocks · Value stocks · Target-date funds · Real estate · Small-cap stocks. This is due to an increased net price and an improved mix. Meanwhile, earnings per share came in at $, and long-term investment stocks received plenty of. As such, dividend stocks are often seen as a safe investment option, as they provide a steady stream of income and are less risky than other.

Apply For Bank Of America Checking Account

Learn more about bank account options for students, teens, and young adults. Review fees and requirements for opening a bank account at Bank of America. Choose Your Checking Account · MasterCard® Debit Card · Just a $25 opening deposit · Manage your accounts with access to online and mobile banking. You can apply online for a checking account, savings account, CD or IRA. Simply select an account, enter your personal information, verify your information. Depending on your preference, you can apply for a Citizens checking account online, over the phone, or at any Citizens branch. To apply online, just select the. Be a Preferred Rewards client (requires a minimum qualifying combined balance of $20, in a Bank of America® deposit and/or Merrill® investment accounts). The. Contact your advisor to enroll — there are no fees to get started or participate. All you need is a Bank of America checking account and a 3-month combined. Earn a $ cash offer when you open a new personal checking account and make qualifying direct deposits. See $ checking offer details. Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account. Regular account fees apply. Open a new eligible business checking account by December 31, Deposit $5, or more in New Money* directly into your new eligible business checking. Learn more about bank account options for students, teens, and young adults. Review fees and requirements for opening a bank account at Bank of America. Choose Your Checking Account · MasterCard® Debit Card · Just a $25 opening deposit · Manage your accounts with access to online and mobile banking. You can apply online for a checking account, savings account, CD or IRA. Simply select an account, enter your personal information, verify your information. Depending on your preference, you can apply for a Citizens checking account online, over the phone, or at any Citizens branch. To apply online, just select the. Be a Preferred Rewards client (requires a minimum qualifying combined balance of $20, in a Bank of America® deposit and/or Merrill® investment accounts). The. Contact your advisor to enroll — there are no fees to get started or participate. All you need is a Bank of America checking account and a 3-month combined. Earn a $ cash offer when you open a new personal checking account and make qualifying direct deposits. See $ checking offer details. Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account. Regular account fees apply. Open a new eligible business checking account by December 31, Deposit $5, or more in New Money* directly into your new eligible business checking.

Bank of America checking or savings account. To allow us to apply and disclose the interest rate reduction and close the loan timely, we encourage Diamond. Sign in and access your BofA Private Bank account The original terms and conditions for your Bank of America accounts and their related services will apply. Checking Accounts · $ minimum to open · $ minimum daily balance or $ average daily balance for the statement cycle* · Interest Bearing Account. Once you open a new Bank of America checking account, or if you already have an existing Bank of America debit card, you can request a debit card in one of the. We offer 3 convenient ways to open a business checking account: Choose your business checking account and apply online; Call · Visit a financial. Checkless account: · Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No. A $12 monthly fee applies to the Advantage Plus account, but it can be waived if you: Cash withdrawals are free at Bank of America ATMs, but you'll have to. Visit your nearest Bank of America location, walk in and ask to register for a bank account. You will be directed to an office in front of a. Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts •View account balances and review. Simplify your life with a Bank of America debit card. All you need is a Bank of America Advantage Banking account to get started. Transfers can be set up between your Bank of America accounts, Merrill Edge accounts or your accounts at other banks account you want to transfer To. Regular account fees apply. Zelle and the Zelle related marks are checking account to your Bank of America® savings account. We may cancel or. You'll need to make a minimum deposit of at least $25 to open a Bank of America SafeBalance Banking account. · To qualify for the bonus, deposits must be made. Bank of America checking or savings account. To allow us to apply and disclose the interest rate reduction and close the loan timely, we encourage Diamond. Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts • View account balances and review. Privately message your name, ZIP code, phone number, inquiry and best time to contact you. Please remember: Don't include account numbers or Social Security. Submitted application for Bank of America SafeBalance checking account on Sunday. Still no response today. Website says that they only take. Certain restrictions apply. Consult your account documents for details checking account to your Bank of America® savings account. We may cancel or. If you have an existing Bank of America Advantage Banking Checking account, you can switch to another setting and keep the same account number and debit card.

Best Car Insurance In Illinois

WalletHub selected 's best car insurance companies in Illinois based on user reviews. Compare and find the best car insurance of American Collectors Insurance provides tailored coverage to fit your needs. We provide peace of mind with top-rated service and affordable coverage. Key Takeaways. Country Insurance & Financial Services is the cheapest insurer in Illinois, with a sample annual rate of $ or $72 monthly. Cheapest Auto Insurance Rates in Illinois ; 2, Safeco, $ / month ; 3, National General Value, $ / month ; 4, NatGen Custom , $ / month ; 5. Before you drive anyone's car, be sure there's an insurance identification card. Your vehicle must be safe to drive. Footer. Back to top. Offices. From Chicago to Jefferson Park and Arlington Heights to Peoria, good drivers in Illinois can get affordable car insurance. It's easy. You should shop around for the best insurance product at the best price. Determine what coverage you need and what it will cost. Obtain more than one quote. Find the right Illinois car insurance coverage for your needs with GEICO. We offer Illinois drivers convenient auto coverage and discounts-get a quote now! The Zebra analyzed third-party reviews from J.D. Power and AM Best, along with thousands of customer ratings in Illinois, to name Erie Insurance the best. WalletHub selected 's best car insurance companies in Illinois based on user reviews. Compare and find the best car insurance of American Collectors Insurance provides tailored coverage to fit your needs. We provide peace of mind with top-rated service and affordable coverage. Key Takeaways. Country Insurance & Financial Services is the cheapest insurer in Illinois, with a sample annual rate of $ or $72 monthly. Cheapest Auto Insurance Rates in Illinois ; 2, Safeco, $ / month ; 3, National General Value, $ / month ; 4, NatGen Custom , $ / month ; 5. Before you drive anyone's car, be sure there's an insurance identification card. Your vehicle must be safe to drive. Footer. Back to top. Offices. From Chicago to Jefferson Park and Arlington Heights to Peoria, good drivers in Illinois can get affordable car insurance. It's easy. You should shop around for the best insurance product at the best price. Determine what coverage you need and what it will cost. Obtain more than one quote. Find the right Illinois car insurance coverage for your needs with GEICO. We offer Illinois drivers convenient auto coverage and discounts-get a quote now! The Zebra analyzed third-party reviews from J.D. Power and AM Best, along with thousands of customer ratings in Illinois, to name Erie Insurance the best.

Are you looking for cheap car insurance in Illinois? Freeway Insurance walks you through how to find affordable car insurance. American Auto Insurance is the best choice in the Chicagoland area. Top 10 Best Car Insurance Companies Near Chicago, Illinois · 1. Jenny Tola - State Farm Insurance Agent. (42 reviews) · 2. Thomas Ward Insurance. ( What are the best car insurance companies in Chicago? The best insurance companies in Chicago are Auto-Owners, State Farm, and Hugo. These three insurers fit a. Travelers and Mercury have the overall cheapest car insurance in Illinois for good drivers, based on the companies in our analysis. The Cheapest Car Insurance. Accurate Auto Insurance is a leader in Illinois car insurance. We offer affordable policies for new drivers, high-risk drivers, and everyone in-between. RateForce makes it easy to get a free quote for car insurance Illinois. Compare rates from top insurers and find best coverage for your needs. When it comes to both minimum and full coverage, GEICO is the best and most affordable car insurance company for most drivers in Illinois. While the above costs. RateForce makes it easy to get a free quote for car insurance Illinois. Compare rates from top insurers and find best coverage for your needs. Geico takes our top spot for the cheapest Illinois car insurance, with rates starting at $18 per month. New Allstate auto insurance in Illinois, with all-new ways to save · Drivewise icon. Save more than ever with a new Drivewise Connect your driving data to save. Clean record and over 21, Erie is probably the cheapest for Illinois. Claims or under 21 Progressive and Dairyland are pretty good. There are many auto insurance companies in Illinois offering great rates. Some of the most popular ones are State Farm, Allstate, Progressive, Geico, CSAA. What Is The Best Auto Insurance In Illinois? State Farm has the best rates for drivers with a minimum coverage rate of $ What Is Minimum Car Insurance. Top 21 auto insurance companies in Illinois · 1. State Farm · 2. American Access Casualty Company · 3. Safeway Insurance Company · 4. Troxell · 5. First Chicago. Lemonade Car offers top-of-the-line coverage and trunkloads of discounts, all while doing our best to make the road (and the world around us) a better place. Cheapest Auto Insurance Rates in Illinois ; 2, Safeco, $ / month ; 3, National General Value, $ / month ; 4, NatGen Custom , $ / month ; 5. Get an Auto Insurance Quote from Illinois Insurance Center. IIC shops leading insurance carriers for your best Auto Insurance Quote in Chicago and all of. What are the best auto insurance companies in Illinois? Some of the best auto insurance companies in Illinois include State Farm, USAA, and GEICO. All three. Country Insurance & Financial Services has the cheapest car insurance in Chicago on average, with a sample yearly rate of $1, or about $ monthly.

What Is Needed To Open An Online Bank Account

Here's the documentation you'll need to open a bank account online: · Identity documents: a copy or photo of your passport or driving license, for example · Proof. If you open it in person, you'll likely need two forms of ID (such as a driver's license, Social Security card, passport or birth certificate) and proof of. What you need to open a checking account · Your Social Security number. · A valid, government-issued photo ID like a driver's license, passport or state or. Compare Checking Accounts from Commerce Bank. Learn about our free checking account, interest checking and student checking. Open a checking account online. What do I need to apply for a bank account online? · A smartphone (and signal) · A valid photo ID (passport or driving licence) · About minutes of your time. All banks require proof of identification (ID) to open an account. They will likely require specific forms of ID. Save yourself the headache of multiple trips. What you need to open a checking account online · Government issued photo ID or driver's license · Social security card or Individual Taxpayer Identification. What do I need to open a checking account? What do you need to open an account online? · Identifying information. · Photo identification. · Contact information. · Co-applicants' identifying information. · An. Here's the documentation you'll need to open a bank account online: · Identity documents: a copy or photo of your passport or driving license, for example · Proof. If you open it in person, you'll likely need two forms of ID (such as a driver's license, Social Security card, passport or birth certificate) and proof of. What you need to open a checking account · Your Social Security number. · A valid, government-issued photo ID like a driver's license, passport or state or. Compare Checking Accounts from Commerce Bank. Learn about our free checking account, interest checking and student checking. Open a checking account online. What do I need to apply for a bank account online? · A smartphone (and signal) · A valid photo ID (passport or driving licence) · About minutes of your time. All banks require proof of identification (ID) to open an account. They will likely require specific forms of ID. Save yourself the headache of multiple trips. What you need to open a checking account online · Government issued photo ID or driver's license · Social security card or Individual Taxpayer Identification. What do I need to open a checking account? What do you need to open an account online? · Identifying information. · Photo identification. · Contact information. · Co-applicants' identifying information. · An.

When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started. Easily open one of our checking or savings accounts online from the safety and comfort of wherever you are. By selecting Open an Account, you're choosing an account with everyday benefits. Customers who plan to deposit $30,+ may be eligible for additional. Open Key Smart Checking® in just 5 minutes · No monthly maintenance fees · No minimum balance or transaction requirements · 40,+ KeyBank and Allpoint® ATMs. You need the same information that is required to open an individual checking account, but you'll need it for both applicants. IDs required to open. How do I. ▫ The services they offer, like online bill payment or a mobile app. ▫ The interest they pay for savings accounts. You usually need to make an initial deposit. You can open a PNC checking account online or in person. You'll need: A U.S. government-issued photo ID such as a driver's license, a non-driving state. To apply you'll need your Social Security Number and a U.S. Government issued ID, like a driver's license or a passport. You also need a means to fund your new. Yes, we do allow minors to open a checking account online. To open an account on your own, you need to be at least 18 years old. However, with a parent or. How to open the checking account · Enter your personal information, including proof of address, and employment type · Request (if available) a debit card for. Find a bank account with the features you need to pursue your financial goals. Explore options from Bank of America and open a bank account online today. In addition to documents that verify your identity, age, or address, you may also need to provide a minimum initial deposit when opening a bank account. You will need two forms of identification – a primary ID and a secondary ID. Only one of the following documents is needed: Foreign passport with or without. You must have a valid Social Security Number or Taxpayer Identification Number in order to enroll in Regions Online Banking. If you are an existing Online. You'll need the following information: Your Social Security number; A valid, government-issued photo ID like a driver's license, passport or state or military. What You Need to Open a Checking Account · a social security number · a US residential address (not a PO box) · Funding account (routing & account number). What do I need to open an account online? To open a checking or savings account, you will need a valid state-issued ID, your SSN, and a computer or mobile. Open a TD Checking Account online in minutes—it's easy and secure. With accounts built for every stage of life, you'll get free Online Banking, Mobile Banking. What will I need to apply for this checking account? Two forms of valid ID are required: Driver's License or State Issued ID or Passport. The second form of.

Can I Use Ebt With Walmart Pay

1) Order groceries at cryptolandia.site or on the. Walmart Grocery mobile app. 2) During checkout, select EBT Card as payment method. 3) Swipe EBT card with. US customers can pay for online orders with a valid Electronic Benefit Transfer (EBT) card, in full or in part. You can use your EBT card at any participating. Can I use EBT on the Walmart shopping app? Yes, you can pay with your EBT Card when checking out on the Walmart app. Add your card to the account wallet. Yes and no, but we're gonna explain. Yes, it will work in a sense. that if your EBT card is linked to the Walmart app, it will show you things online that are. Use any Electronic Benefits Transfer (EBT) balances, such as WIC & SNAP before using Walmart Pay. Open your Walmart app & tap Walmart Pay. Use Touch ID or enter. Participating online stores now accept SNAP benefits for online orders and will deliver to you. Use your EBT card to shop securely for fresh produce and. SNAP & EBT cash accepted online. Add a card to your account to use funds. *SNAP / EBT can only be used for club purchases. Pickup orders are online purchases and cannot be paid for using SNAP. **Healthy Benefits+ can only be used. Create an account on the Walmart app or the website and place your order. Tap or click Payment methods. You will see an option to add your EBT card to your. 1) Order groceries at cryptolandia.site or on the. Walmart Grocery mobile app. 2) During checkout, select EBT Card as payment method. 3) Swipe EBT card with. US customers can pay for online orders with a valid Electronic Benefit Transfer (EBT) card, in full or in part. You can use your EBT card at any participating. Can I use EBT on the Walmart shopping app? Yes, you can pay with your EBT Card when checking out on the Walmart app. Add your card to the account wallet. Yes and no, but we're gonna explain. Yes, it will work in a sense. that if your EBT card is linked to the Walmart app, it will show you things online that are. Use any Electronic Benefits Transfer (EBT) balances, such as WIC & SNAP before using Walmart Pay. Open your Walmart app & tap Walmart Pay. Use Touch ID or enter. Participating online stores now accept SNAP benefits for online orders and will deliver to you. Use your EBT card to shop securely for fresh produce and. SNAP & EBT cash accepted online. Add a card to your account to use funds. *SNAP / EBT can only be used for club purchases. Pickup orders are online purchases and cannot be paid for using SNAP. **Healthy Benefits+ can only be used. Create an account on the Walmart app or the website and place your order. Tap or click Payment methods. You will see an option to add your EBT card to your.

You can not. You can do OGD/P with EBT but not in store on walmart pay.

These payment methods include debit and credit card payments, PayPal, Walmart gift cards, prepaid debit cards, or EBT payments,. Just have in mind that. Walmart online accepts EBT Cash for payments. You can use EBT cash to cover the cost of delivery fees. You can also pick up your groceries at participating. No one should be unable to get the medical care they need. It is long past time to increase the federal minimum wage from a starvation wage of $ an hour to. Did you know you can use EBT for Online Grocery orders? To add a payment method, go to the Walmart app and select “Account.” Once you are in your. It is possible to pay for groceries using an EBT card at Walmart, but it depends on the specific store's policies and procedures. Some Walmart. Can I use EBT on the Walmart shopping app? Yes, you can pay with your EBT Card when checking out on the Walmart app. Add your card to the account wallet. Walmart accepts EBT at all Walmart Grocery locations. Currently, Walmart does not accept WIC or eWIC. • For Pickup - At most stores, you can pay for your order. Amazon does not accept EBT cash benefits; however, EBT cash benefits can be used to pay for Walmart Grocery delivery fees. Walmart delivers in a radius of nine. Due to federal rules, you can only use your SNAP benefits to buy SNAP eligible food items. You must pay for fees with another form of payment, like a credit. Save money. Live better. The Walmart app is the easiest way to shop for everything on your list, including fresh groceries, household essentials, the latest. You can now pay for Walmart online grocery with EBT. You can also use your SNAP benefits online at Instacart, Amazon, BJ's Wholesale, Kroger, and more. Can I use my EBT card to cover the delivery fee? No. SNAP benefits cannot be used to cover the delivery fee at Walmart. You must pay for fees with another form. You also have the option to use multiple forms of payment, such as an EBT card and a debit card, in one shopping trip. While you can receive a delivery of goods. Walmart Online page in the app or on your computer. 3. Pay with a connected card. Use either your Walmart Pay account through the Walmart App or the payment. Walmart: Accepts EBT payment during checkout and offers pickup service; King Soopers: Offers pickup service and EBT payment at pickup; Safeway/Albertson's. Amazon and participating ShopRite and Walmart stores currently accept online EBT payments in How much are service and delivery fees, and can I use my EBT card. If you get CalWORKs, you can use your cash benefit to pay for delivery at Walmart. 8. Can I use my EBT card to buy non-food items? If you only get CalFresh food. Additionally, EBT cardholders are able to use their benefit cards for online purchasing at Safeway, Amazon, Walmart, and more. Where Can I Use My EBT Card. Walmart accepts EBT card purchases at all locations that sell food and grocery items. Your EBT card can be used the same way you would use your debit card, and. Sign into your Walmart pickup & delivery account. If you don't have one create an account. • Select Payment Methods. • If your local store accepts EBT Online.

Secure Credit Card Processor

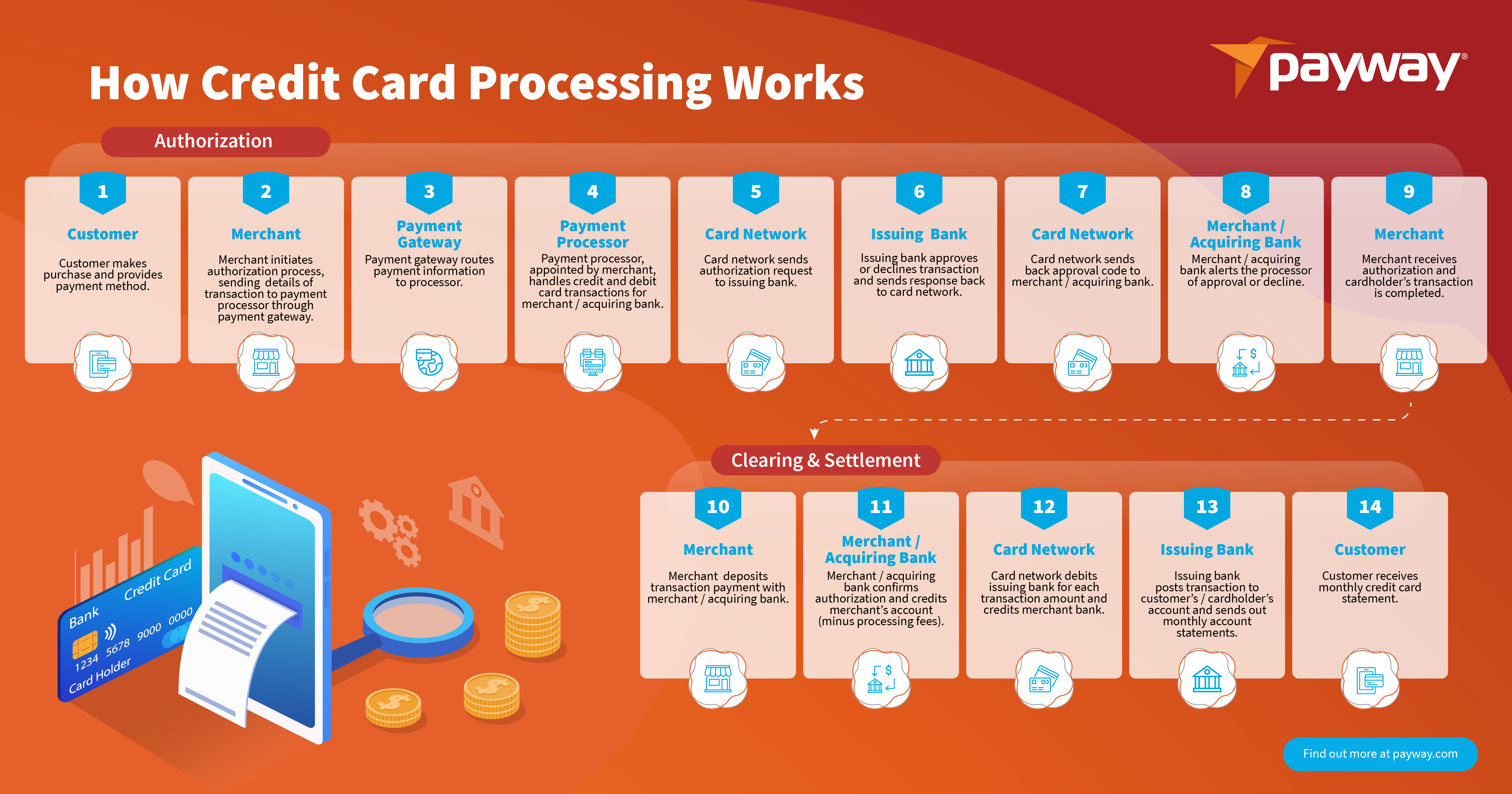

With Sage, debit and credit card processing is secure and compliant. Accept all major credit cards and debit cards, including Visa®, MasterCard®, American. Our company has processed over $m in payments and helped hundreds of merchants accept credit cards securely. We specialize in Retail, Restaurants. Honest credit card processing with low rates for businesses small and large. Accept credit cards in person, online, or on the go! The most trusted name in credit card processing. Accept payments any time, any where. Gravity integrates with hundreds of hardware and software solutions. BASYS is a family-owned payment processor that specializes in making credit and debit card acceptance convenient, secure, and affordable. Curbside, in shop or on the go, take credit card payments wherever your business takes you. With flexible devices and contactless payment options, Heartland. Point-to-point encryption. Our military-grade encryption helps safeguard sensitive payment information so that it can pass safely between merchant and customer. The monthly subscription includes web-hosted payment links, Text2Pay mobile payments, secure storage of customer credit cards, recurring invoices and scheduled. Trust your credit card processing needs to a secure payment gateway. We're a Level 1 PCI compliant processor that protects you with Fraud Scrub technology. With Sage, debit and credit card processing is secure and compliant. Accept all major credit cards and debit cards, including Visa®, MasterCard®, American. Our company has processed over $m in payments and helped hundreds of merchants accept credit cards securely. We specialize in Retail, Restaurants. Honest credit card processing with low rates for businesses small and large. Accept credit cards in person, online, or on the go! The most trusted name in credit card processing. Accept payments any time, any where. Gravity integrates with hundreds of hardware and software solutions. BASYS is a family-owned payment processor that specializes in making credit and debit card acceptance convenient, secure, and affordable. Curbside, in shop or on the go, take credit card payments wherever your business takes you. With flexible devices and contactless payment options, Heartland. Point-to-point encryption. Our military-grade encryption helps safeguard sensitive payment information so that it can pass safely between merchant and customer. The monthly subscription includes web-hosted payment links, Text2Pay mobile payments, secure storage of customer credit cards, recurring invoices and scheduled. Trust your credit card processing needs to a secure payment gateway. We're a Level 1 PCI compliant processor that protects you with Fraud Scrub technology.

securely enter their credit card information online and get it authorized. These generally come bundled together with payment processing services, too. How. An ultimate guide for merchants on credit card payment processing. Learn about payment compliance and security, merchant fees and how a card is processed. Processors, along with merchants, are responsible for maintaining compliance with the Payment Card Industry Data Security Standards (PCI DSS). Some payment. How to prevent security breaches and data theft; How to ultimately choose the right credit card processor for your unique business. Helcim saves you 25% on in-person and online credit card payments with no hidden fees, no monthly fees, and no contracts. Get started for free. Assess security and PCI compliance. Every consumer has a right to secure payment processing that protects their data. You need to work closely with your credit. This can speed up the checkout process and keep customers feeling safe. Most newer POS terminals have built-in tap-to-pay capabilities. Funds: We also. Therasoft offers secure credit card processing solutions, ensuring safe and seamless transactions for healthcare providers and their patients. Chase Payment Solutions℠. One trusted partner. A complete suite of payment solutions to accept credit cards, made simple and secure. All-in-One Payment Processing Solution for Microsoft Dynamics Business Central. Elavon is the innovative, secure, and global partner for your payment processing needs, whether you do business online, mobile, or in-person. Sage products give you the most secure, compliant debit and credit processing solutions. Accept all major credit cards and keep track of cash flow in your. Square Point of Sale · Helcim · Intuit QuickBooks Payments · Payline Data · Cayan · Payment Depot · Credit Card cryptolandia.site · Flagship Merchant Services. Merchant Services is designed to make payment processing simple, secure, and affordable. Both a credit card gateway and processor, you benefit from the. secure processing services for debit and credit – from authorization to clearing and settlement. Hand holding cash icon Access ATM and payment networks. LawPay helps lawyers securely process debit and credit card payments. Elevate your legal practice with seamless transaction processing and get paid faster. Credit card processing is what allows businesses to securely accept payments made via credit, debit, gift, and even loyalty cards. Toast payment processing is an integrated solution designed specifically for restaurants. Accept payments seamlessly and securely to power your restaurant. Eliminate the burden of separate loyalty, fraud protection, card production and network service systems. Digital-first card capabilities. Power secure digital. Yes, credit card machines are generally safe as they encrypt transaction data to protect customers' information. What are the benefits of using credit card.

Best Podcast To Learn About Stocks

The Investing for Beginners Podcast · Created playlists · Shorts · Unlock Financial Freedom: Learn How to Navigate Your Money with Financial Birds and Bees · A. The Australian Finance Podcast · Shares for Beginners · You Need a Budget · Bad with Money · The Investors Podcast · Her Money · Afford Anything · So Money. Stock Market Podcasts For Beginners · 1. Motley Fool Money · 2. Chat With Traders · 3. Rich Dad Radio Show · 4. Daily Stock Market News · 5. Get Started. Learn how companies work from the people who know them best. We do deep research and interview industry veterans, investment professionals, and business leaders. We make the complicated stock market simple. We show you how to take advantage of the emotions in the market with lessons from successful strategies. The Investing for Beginners Podcast - Your Path to Financial Freedom · De: By Andrew Sather and Dave Ahern | Stock Market Guide to Buying Stocks like · Podcast. Join the Sim & Sonya from Girls That Invest, the #1 investing podcast ✓ Maybe I can understand how to best invest in and beyond. ✓ Maybe I. On Watch by MarketWatch · Barron's Streetwise · At Barron's · On Watch by MarketWatch · Barron's Advisor · Barron's Australia · Barron's Live · Best New Ideas in Money. All Episodes · Crypto, VIX, seasonality: Best of Stocks in Translation · Why investors should get ready for a busy month · This trader's 'most frightening moment'. The Investing for Beginners Podcast · Created playlists · Shorts · Unlock Financial Freedom: Learn How to Navigate Your Money with Financial Birds and Bees · A. The Australian Finance Podcast · Shares for Beginners · You Need a Budget · Bad with Money · The Investors Podcast · Her Money · Afford Anything · So Money. Stock Market Podcasts For Beginners · 1. Motley Fool Money · 2. Chat With Traders · 3. Rich Dad Radio Show · 4. Daily Stock Market News · 5. Get Started. Learn how companies work from the people who know them best. We do deep research and interview industry veterans, investment professionals, and business leaders. We make the complicated stock market simple. We show you how to take advantage of the emotions in the market with lessons from successful strategies. The Investing for Beginners Podcast - Your Path to Financial Freedom · De: By Andrew Sather and Dave Ahern | Stock Market Guide to Buying Stocks like · Podcast. Join the Sim & Sonya from Girls That Invest, the #1 investing podcast ✓ Maybe I can understand how to best invest in and beyond. ✓ Maybe I. On Watch by MarketWatch · Barron's Streetwise · At Barron's · On Watch by MarketWatch · Barron's Advisor · Barron's Australia · Barron's Live · Best New Ideas in Money. All Episodes · Crypto, VIX, seasonality: Best of Stocks in Translation · Why investors should get ready for a busy month · This trader's 'most frightening moment'.

Latest podcasts produced by Seeking Alpha's staff and from Seeking Alpha's contributors. Includes stock market, investing and retirement savings podcasts. Motley Fool Money is a daily podcast for stock investors. Weekday episodes offer a long-term perspective on business news with The Motley Fool's investment. Today, Equity Mates is Australia's best investing podcast for millennials. Twice a week, Bryce and Alec will take you from beginning to dividend, chat to. Check out Barron's Streetwise, hosted by Jack Hough. mostly interviews with people in the finance or business worlds. this is a good starting point. 1. The Clark Howard Podcast · 2. Bloomberg Masters in Business Podcast · 3. Exchanges at Goldman Sachs · 4. Fast Money Podcast · 5. Real Vision Daily Briefing. Stock Market Podcasts For Beginners · 1. Motley Fool Money · 2. Chat With Traders · 3. Rich Dad Radio Show · 4. Daily Stock Market News · 5. Get Started. cryptolandia.site: Learn how to Trade Stocks with Robert Beck | a Podcast by MONEY MASTERS | trading stocks, momentum, swing trading, position trading, day trading. Top Investing Podcasts · All-In with Chamath, Jason, Sacks & Friedberg · My First Million · Acquired · Invest Like the Best with Patrick O'Shaughnessy · Masters. The Bid investment podcasts breaks down what's happening in the markets and explores the forces that are changing investing. Listen now. Listen to So Money · Listen to Clever Girls Know · Listen to The Financial Confessions · Listen to The Fairer Cents · Listen to Journey to Launch · Listen to Afford. Making Sense: Commercial & Investment Bank podcasts Making Sense brings you insights across our Investment Banking, Markets and Research businesses. In each. Our newly reimagined Human-centric Investing Podcast features minute conversations with inspiring thought leaders from inside and outside the financial. Best Overall: The Investor's Podcast 2. Best for Beginner Investors: Stacking Benjamins 3. Best basics of stocks and investing. Every week, host Tracey Ryniec will be joined by guests to discuss the hottest investing topics in stocks, bonds and ETFs and how it impacts your life. Our newly reimagined Human-centric Investing Podcast features minute conversations with inspiring thought leaders from inside and outside the financial. Our podcasts ; On Investing. Markets and Economy. Focus on Labor · September 06, · Liz Ann Sonders • Kathy Jones ; Choiceology. Behavioral Finance. The Truth. Making Sense: Commercial & Investment Bank podcasts Making Sense brings you insights across our Investment Banking, Markets and Research businesses. In each. 15 Best Financial Podcasts About Money, Business & Investing in · 1. The Dave Ramsey Show. Dave Ramsey is an icon in the world of personal finance. · 2. So. Listen to Daily Stock Market News on Spotify. Whether you're a novice trader or an experienced investor, the Daily Stock Market News podcast will keep you. Learn from our industry leaders about how to manage your Get the latest insights, analyses and market trends in our newsletter, podcasts and videos.

Is It Worth Getting A Lowes Credit Card

Overall, Lowes credit card is mostly recommended based on community reviews that rate customer service and user experience. 1% cash back equals 1 point for each $1 spent, which equates to $ in Lowe's Rewards. Points can be used to cover specific, eligible charges to receive. However, the card is worth it only if you don't have to pay the standard APR on any of your purchases — which means you need to be sure you can make your. The Lowe's Business Rewards Card is a cash back credit card designed for business owners who shop at Lowe's. You get a 5% discount on Lowe's purchases when you. The ship to your home is free if you buy at least $35 worth of merch, but I have a credit card. I have excellent credit. this is ridiculous. I'm a. 5% offer applies to eligible US Lowe's store and cryptolandia.site purchase or order after all other applicable discounts charged to your MyLowe's Rewards Credit Card. Everyday Offers · Limited-Time Offers · Additional Financing Options · Financial Tools · 5% Off Every Day or 6 Months Special Financing or 84 Fixed Monthly Payments. Both the Lowe's Advantage Card and the Home Depot Consumer Credit Card offer financing options, but the Lowe's Advantage Card also has an everyday discount. Yes, we can say that the Lowe's Advantage Credit Card is said to be one of the most challenging store cards to obtain, with candidates often. Overall, Lowes credit card is mostly recommended based on community reviews that rate customer service and user experience. 1% cash back equals 1 point for each $1 spent, which equates to $ in Lowe's Rewards. Points can be used to cover specific, eligible charges to receive. However, the card is worth it only if you don't have to pay the standard APR on any of your purchases — which means you need to be sure you can make your. The Lowe's Business Rewards Card is a cash back credit card designed for business owners who shop at Lowe's. You get a 5% discount on Lowe's purchases when you. The ship to your home is free if you buy at least $35 worth of merch, but I have a credit card. I have excellent credit. this is ridiculous. I'm a. 5% offer applies to eligible US Lowe's store and cryptolandia.site purchase or order after all other applicable discounts charged to your MyLowe's Rewards Credit Card. Everyday Offers · Limited-Time Offers · Additional Financing Options · Financial Tools · 5% Off Every Day or 6 Months Special Financing or 84 Fixed Monthly Payments. Both the Lowe's Advantage Card and the Home Depot Consumer Credit Card offer financing options, but the Lowe's Advantage Card also has an everyday discount. Yes, we can say that the Lowe's Advantage Credit Card is said to be one of the most challenging store cards to obtain, with candidates often.

American Express can be accepted at 99% of places in the US that accept credit cards.1 1Based on the Feb Nilson Report. All Benefits & Features. Yes, we can say that the Lowe's Advantage Credit Card is said to be one of the most challenging store cards to obtain, with candidates often. Happy New Year! I'm going to get a credit card with Lowes or Home Depot. Any major differences between the Consumer and the Commercial cards I shoul. MyLowe's Rewards Credit Card · Receive 5% off · Pay 0% APR for 6 months · Enroll in special financing with a low, fixed APR. The Lowe's Credit Card is one of the best store credit cards on the market right now. It offers 5% back on all purchases and has a $0 annual fee. New cardholders can get 5% cash back on eligible Lowe's purchases for the first six months. Check out our recommended alternatives below if this card doesn't. Need a little help staying on budget with your home renovation project? A Lowe's credit card could be the way to go; it gets you 20% off for opening an. PreLoad Plus Mastercard No credit check8 and no monthly fees. Shop at Lowe's and anywhere Mastercard® is accepted. Automatic rebates on fuel, dining and. If you want to add the Lowes net 30 account to your credit mix, visit the Lowes business credit card center. In our article Can You Buy a House with Business. The Lowe's Advantage Card (LAC) is the Lowe's private label consumer credit card. *5% OFF Your Lowe's Advantage Card Purchase: Get 5% off your eligible. *Save 5% Every Day Get 5% off your eligible purchase or order charged to your MyLowe's Rewards Credit Card. Valid for purchases in US stores and on cryptolandia.site When you get to the register, you're given a choice of which Lowe's Advantage Card benefit you want to take advantage of: 5% off your purchase or financing (how. CREDIT PROMOTION DETAILS: Offers subject to credit approval and cannot be combined. If your MyLowe's Rewards Credit Card purchase or order is over the. The MyLowe's Rewards Credit Card is a credit card that can be used in Lowe's stores and online at cryptolandia.site The card provides perks and bonuses for cardholders. Lowe's Points: For each U.S. dollar spent using the. Lowe's Business Rewards Card from American Express, get: three (3) points at restaurants, office supply. The card's most appealing features are its $0 annual fee and the 5% discount it gives on all eligible purchases at Lowe's, cryptolandia.site, & cryptolandia.site Get 5% off on every purchase at Lowe's and cryptolandia.site when you use your Lowe's PreLoad Card. Discount applied as a statement credit. See here for details. If you're a Costco member, this card gives you cash back. on a lot of different categories. I believe the highest is gas. It also comes with, like, a bunch of. *5% Off Your MyLowe's Rewards Credit Card Purchase: Get 5% off your eligible purchase or order charged to your MyLowe's Rewards Credit Card. Valid for purchases. MyLowe's Money is not a credit, debit or gift card; it has no implied warranties. MyLowe's Money can be redeemed towards purchases of eligible products in.

How Much Do I Need For A 300k House

Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. The monthly mortgage payment includes principle. I presume the interest deduction would offset property taxes. But you would still need to dig out extra money for maintenance and repairs, perhaps $1,$2, For a $, home with a house payment of $2,, you'd need about $7, per month, or $93, per year, in income to stay within 28%. Back-end DTI is more. Choose how the property will be used. You'll also need to select the property use — this should be “primary residence” in order to meet reverse mortgage. How much do I need to make to afford a $k house? Since annual income is only one factor lenders consider, people with a variety of incomes can afford a. In other words, the purchase price of a house should equal the total amount of the mortgage loan and the down payment. Often, a down payment for a home is. How much of your income should go toward a mortgage? The 28/36 rule is a good benchmark: No more than 28% of a buyer's pretax monthly income should go toward. How much of a down payment do you need for a house? ; 20%, $60,, $,, $1, ; 15%, $45,, $,, $1, One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt and credit, as well as how much you have saved for a. Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. The monthly mortgage payment includes principle. I presume the interest deduction would offset property taxes. But you would still need to dig out extra money for maintenance and repairs, perhaps $1,$2, For a $, home with a house payment of $2,, you'd need about $7, per month, or $93, per year, in income to stay within 28%. Back-end DTI is more. Choose how the property will be used. You'll also need to select the property use — this should be “primary residence” in order to meet reverse mortgage. How much do I need to make to afford a $k house? Since annual income is only one factor lenders consider, people with a variety of incomes can afford a. In other words, the purchase price of a house should equal the total amount of the mortgage loan and the down payment. Often, a down payment for a home is. How much of your income should go toward a mortgage? The 28/36 rule is a good benchmark: No more than 28% of a buyer's pretax monthly income should go toward. How much of a down payment do you need for a house? ; 20%, $60,, $,, $1, ; 15%, $45,, $,, $1, One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt and credit, as well as how much you have saved for a.

How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. The monthly mortgage payment includes principle. The provided values for interest rates are examples only and do not reflect Churchill Mortgage Product terms & offers. How Much House Can I Afford? Homeowners insurance is your security blanket but it does a lot more. See what homeowners insurance covers, when it is required & how it can affect your taxes. One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt and credit, as well as how much you have saved for a. This means that if you want to buy a $, house, you might need to make an earnest money payment between $3, and $15, There is no hard-and-fast rule. The monthly mortgage payment includes principle, interest, property taxes, homeowner's insurance and any other fees that must be included. To determine how much. Using a rule of thumb, lenders might offer up to 4 times your annual salary. For a mortgage on k, an annual income hovering around £75, or more would be. More from SmartAsset. How much house can you afford? Calculate your monthly mortgage payment · Calculate your closing costs · Should you rent or buy? % of the total cost of the house, in savings, to account for closing costs. Thus, our $, first-time homebuyer should sock away about $6,?$7, Over , verified 5-star reviews. Next. ADVERTISEMENT CrossCountry Mortgage. NMLS # How much do I need to make to afford a $, home? And how much. Following this logic, you would need to earn at least $, per year to buy a $, home, which is twice your salary. This is a general guideline, of. Wondering how much you need to make to qualify for a mortgage? Use our mortgage required income calculator to get an idea of how much mortgage you can. How would you rate your experience using this SmartAsset tool? 1 2 3 4 5. Needs improvement. Excellent. For example, suppose you secure a year fixed $K mortgage at % APR. In this case, the monthly payment would be $1, On the other hand, if you have a. Your debt-to-income ratio (DTI) should be 36% or less. · Your housing expenses should be 29% or less. This is for things like insurance, taxes, maintenance, and. More Mortgage Calculators How Much House Can I Afford? How Much Do I Have To Earn? How Much Can I Borrow? With Rate Relief by Churchill Mortgage, you'll. Monthly Pay: $1, ; Monthly, Total ; Mortgage Payment, $1,, $, ; Property Tax, $, $, ; Home Insurance, $, $45, ; Other. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. % of the total cost of the house, in savings, to account for closing costs. Thus, our $, first-time homebuyer should sock away about $6,?$7, to.