cryptolandia.site

Categories

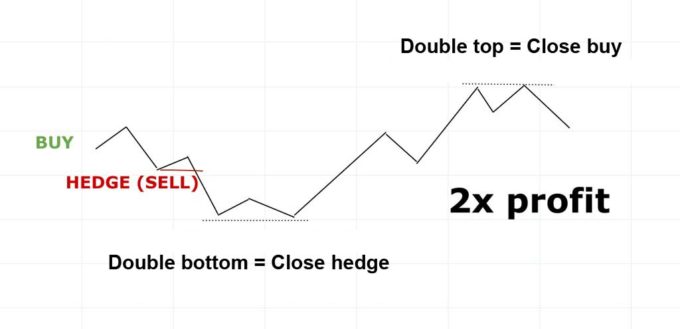

What Is Hedge Trading

Learn about some of the most effective hedging strategies that can be used when spread betting or trading CFDs within the financial markets. How does hedging work in Forex trading? Hedging involves opening a trade or trades opposite in direction to an existing position. This helps mitigate risk by. Hedging is a risk management strategy employed to offset losses in investments by taking an opposite position in a related asset. The reduction in risk provided. Hedging is a financial strategy used to protect a trader from losing trades resulting from adverse moves of currency pairs. Quick Summary: Traders will hedge a bet in order to reduce the risk associated with the initial position they have taken up. This normally means placing a. What is hedging? When the price of metal changes it This can give the impression that trading is gambling, more akin to poker than to risk management. Hedging is the practice of opening multiple positions at the same time to protect your trading or investment portfolio from volatility or uncertainty within the. In finance, a hedge is an investment or trading strategy used to offset or minimise the risk of adverse price movements in another asset or position. It can be. Hedging is the purchase of one asset with the intention of reducing the risk of loss from another asset. Learn about some of the most effective hedging strategies that can be used when spread betting or trading CFDs within the financial markets. How does hedging work in Forex trading? Hedging involves opening a trade or trades opposite in direction to an existing position. This helps mitigate risk by. Hedging is a risk management strategy employed to offset losses in investments by taking an opposite position in a related asset. The reduction in risk provided. Hedging is a financial strategy used to protect a trader from losing trades resulting from adverse moves of currency pairs. Quick Summary: Traders will hedge a bet in order to reduce the risk associated with the initial position they have taken up. This normally means placing a. What is hedging? When the price of metal changes it This can give the impression that trading is gambling, more akin to poker than to risk management. Hedging is the practice of opening multiple positions at the same time to protect your trading or investment portfolio from volatility or uncertainty within the. In finance, a hedge is an investment or trading strategy used to offset or minimise the risk of adverse price movements in another asset or position. It can be. Hedging is the purchase of one asset with the intention of reducing the risk of loss from another asset.

Hedging with options involves opening a position – or multiple positions – that will offset risk to an existing trade. When trading crypto options contracts, an investor can either buy calls (the future right to buy an asset at a specific price) or puts (the future right to sell. A hedge is an investment or trade designed to reduce your existing exposure to risk. This process of reducing risk is called “hedging“. Hedging is the investment or trading technique of buying instruments that offset positions such that if a loss is created by one position, it is offset by. Hedging relates to risk management, and refers to a strategic attempt to offset or reduce risk in a position or portfolio. Learn how it works. Hedging refers to an asset risk management strategy that tries to minimize losses. Most commonly, traders use derivatives offsetting strategies to protect their. To implement a hedging strategy, traders may first identify the risk they want to hedge against, choose an instrument, calculate the optimal hedge ratio. The hedging meaning in finance refers to holding two or more open positions when trading. If there are any losses from your first investment position, you'll be. What is hedging in Forex? When a currency trader enters into a trade with the intent of protecting an existing or anticipated position from an unwanted move in. Selling futures is called a short hedge; buying futures is called a long hedge. trading venues, to keep markets in line. Stocks with high daily trading. What is Hedging? Hedging is a financial strategy that should be understood and used by investors because of the advantages it offers. As an investment, it. What is Hedging in the Stock Market. Hedging is the purchase of one asset with the intention of reducing the risk of loss from another asset. In finance. equal to the correlation, ρ. Trading Strategies Using Options. Basic trading strategies include the use of the following: • Take a position in the option. Hedging is the process of opening a trade position in the market to offset the risk of another investment or trade position. Pairs hedging, sometimes referred to as pairs trading, takes two positions on two different assets — one that's going up and one that's going down. The. A hedge is an investment or trade designed to reduce your existing exposure to risk. The process of reducing risk via investments is called 'hedging'. A hedge is an investment to counter or minimize the risk of adverse price movements in an asset or security. More importantly, investors hedge one investment by trading in another. What do hedge funds do? Hedging in finance is not a technique for generating a profit. Hedging in the stock market is a strategy investors use to reduce the risk of adverse price movements in an asset. This process involves taking on an offsetting. A stock hedge is an asset or investment used to offset an existing position to reduce risk. Investors use hedges to reduce the risk of a particular stock or.

Buy Steel Stocks

X | Complete United States Steel Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. I have a list of the best steel stocks in India and also I've written a detailed blog about each stock. You can learn about the best steel. Steel Stocks FAQ · 1. Steel Dynamics (NASDAQ:STLD) · 2. Commercial Metals Co (NYSE:CMC) · 3. Reliance (NYSE:RS) · 1. National Steel Co (NYSE:SID) · 2. Mesabi. ranked list of publicly traded Carbon Steel companies. Find the best Carbon Steel Stocks to buy. Carbon steel is a steel with carbon content up to % by. Investing in Steel Stocks · 1. Nucor · 2. Steel Dynamics · 3. Cleveland-Cliffs · 4. ArcelorMittal · 5. U.S. Steel. Sorted by any necessary metric, it can show the most expensive stocks of the industry such as Reliance, Inc. or those with the best price dynamics like. On further gains, the stock will meet resistance from the long-term Moving Average at $ On a fall, the stock will find some support from the short-term. Get free shipping on qualified Metal Stock products or Buy Online Pick Up in Store today in the Hardware Department. Steel ; Market Cap. B ; Revenue. B ; Profits. B ; PE Ratio. ; Profit Margin. %. X | Complete United States Steel Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. I have a list of the best steel stocks in India and also I've written a detailed blog about each stock. You can learn about the best steel. Steel Stocks FAQ · 1. Steel Dynamics (NASDAQ:STLD) · 2. Commercial Metals Co (NYSE:CMC) · 3. Reliance (NYSE:RS) · 1. National Steel Co (NYSE:SID) · 2. Mesabi. ranked list of publicly traded Carbon Steel companies. Find the best Carbon Steel Stocks to buy. Carbon steel is a steel with carbon content up to % by. Investing in Steel Stocks · 1. Nucor · 2. Steel Dynamics · 3. Cleveland-Cliffs · 4. ArcelorMittal · 5. U.S. Steel. Sorted by any necessary metric, it can show the most expensive stocks of the industry such as Reliance, Inc. or those with the best price dynamics like. On further gains, the stock will meet resistance from the long-term Moving Average at $ On a fall, the stock will find some support from the short-term. Get free shipping on qualified Metal Stock products or Buy Online Pick Up in Store today in the Hardware Department. Steel ; Market Cap. B ; Revenue. B ; Profits. B ; PE Ratio. ; Profit Margin. %.

United States Steel stock has received a consensus rating of hold. The average rating score is and is based on 9 buy ratings, 16 hold ratings, and 3 sell. I am holding shares of Tata Steel at average price, now as the stock is declining, should I hold this or sell at loss? Steel Stocks ; Universal Stainless & Alloy Products, Inc. USAP · $ ; Scully Royalty Ltd SRL · $ ; United States Steel Corp. X · $ ; Steel Dynamics Inc. Yahoo Finance's Steel performance dashboard help you filter, search & examine stock performance across the Steel industry at large. Best Steel Stocks ; United States Steel (NYSE:X) · $ ; Steel Dynamics (NASDAQ:STLD) · $ ; Cleveland-Cliffs (NYSE:CLF) · $ ; Ternium (NYSE:TX) · $ Steel Stocks FAQ · 1. Steel Dynamics (NASDAQ:STLD) · 2. Commercial Metals Co (NYSE:CMC) · 3. Reliance (NYSE:RS) · 1. National Steel Co (NYSE:SID) · 2. Mesabi. United States Steel Corporation, more commonly known as U.S. Steel, is an American integrated steel producer headquartered in Pittsburgh, Pennsylvania. ranked list of publicly traded Structural Steel companies. Find the best Structural Steel Stocks to buy. Structural steel is a type of steel that is used in. Top Iron & Steel Stocks in India by Market Capitalisation: Get the List of Top Iron & Steel Companies in India (BSE) based on Market Capitalisation. A Comprehensive Guide to Buying Steel Stocks on the NYSE: Tips and Strategies cryptolandia.site Investing in steel stocks on the New. STEEL | A complete NYSE American Steel Index index overview by MarketWatch p Barron's Buy Broadcom Stock, Analyst Says. A Chip Bottom Could Be. We explain how to buy United States Steel Corporation stock, compare the best stock trading platforms and use a detailed analysis to learn about (X). The 8 Best Steel Stocks To Buy For Portfolio Strength · 1 Best Steel Stocks To Buy. Nucor (NYSE: NUE) · 2 Stainless Steel Stocks. Valhi (NYSE: VHI) · 3. The tariffs implemented on steel are unlikely to prove it as durable. Therefore, it is not the right time to make an investment in steel stocks now. However. View the real-time X price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Steel Stocks: Explore the List of Steel Stock Companies in India to Buy. Get Insights on Share Prices and Market Cap. Start Investing in Steel Shares with. Steel. Chinese stocks. Steel. Chinese companies operating in the same steel industry. The list below has Chinese companies that operate under the same industry. Tata Steel Ltd. Usha Martin Ltd. JSW Steel Ltd. Tata Metaliks Ltd. Lloyds Metals. The Dividend Reinvestment and Stock Purchase Plan provides shareholders with a convenient way to purchase additional shares of Common Stock without payment of. Iron & Steel Dividend Stocks, ETFs, Funds ; BHP Group Limited - ADRBHP Group Limited ADR. BHP · $ %. $ B ; Rio Tinto plc - Registered SharesRio.